The Employee Retention Tax Credit (ERTC, also referred to as the ERC credit) was made available to businesses as an employment tax credit throughout the pandemic. This change was enacted through the Coronavirus Aid, Relief, and Economic Security Act (CARES) on March 27, 2020, and extended through the Consolidated Appropriations Act, 2021 (CAA) and the American Rescue Plan Act (ARPA).

The Washington Department of Revenue (DOR) released guidance clarifying the Washington business and occupation (B&O) tax treatment of COVID-19 related relief.

This alert augments an earlier article published by Moss Adams addressing the B&O tax treatment of PPP loan forgiveness.

Employee Retention Tax Credit Update

In November 2021, the Infrastructure Investment and Jobs Act (IIJA) was signed by President Joe Biden, retroactively terminating the ERC credit for the fourth quarter of 2021. This limited the availability of credit to qualified periods between March 13, 2020, through September 30, 2021.

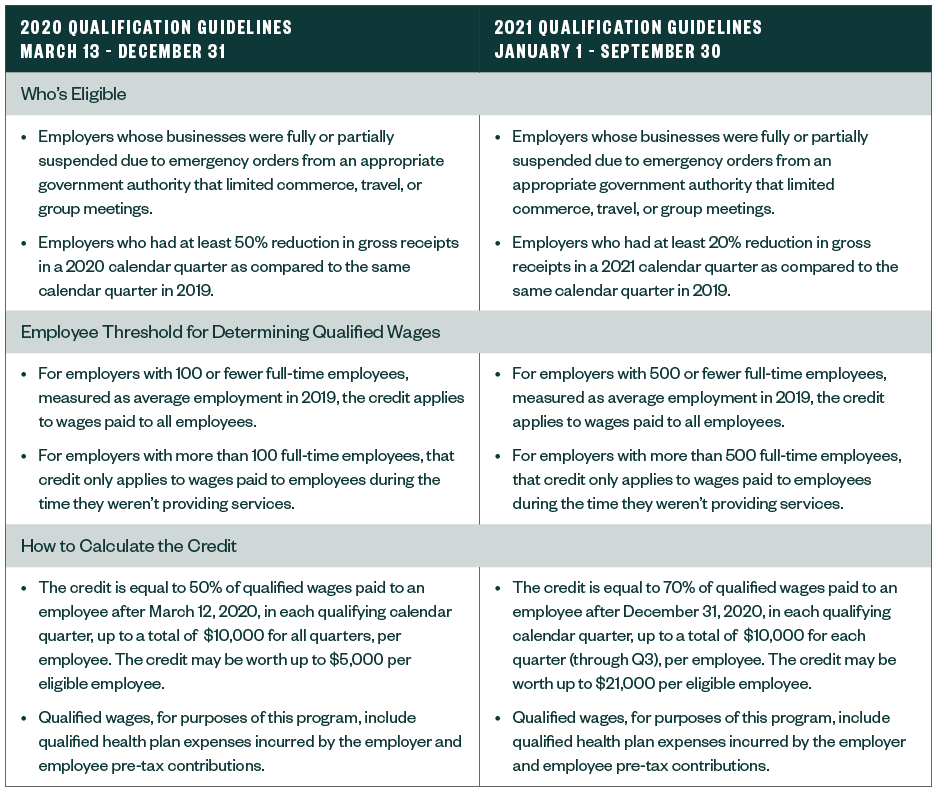

Below are details about how employers could qualify as well as eligibility requirements.

ERC Credit Eligibility and Guidelines

Washington State B&O Tax Treatment

Under GAAP, for-profit enterprises have several allowable accounting conventions to record the ERC credit. The most common convention for-profit enterprises use is to account for the credit related to previously paid payroll taxes as a loss recovery. When the loss recovery becomes probable under Accounting Standards Board (ASB) Topic 450, a for-profit enterprise would record the transaction as a debit to accounts receivable and a credit to either payroll tax expense or recorded as other income.

Where a business was eligible for the ERC credit and received it, this then brings into question whether ERC funds are gross income subject to Washington B&O tax.

Financial assistance programs established by the Federal government for COVID-19 relief have been contemplated by the Washington State Department of Revenue (DOR), where funds received were given an exemption under HB 1095 as qualifying grants defined as an amount received that concurrently meet all of the following criteria:

- Relief from debt or other legal obligation received

- Received under a government-funded program

- Is provided to address the impacts of conditions giving rise to an official proclamation of a national emergency by the president of the United States or the governor of Washington

- Isn’t received under a contract, for manufacturing, extracting, or selling products

Washington has also codified that B&O tax doesn’t apply to any person with respect to the value proceeding or accruing from a qualifying grant received on or after February 29, 2020.

Because the ERC credit may meet the definition of a qualifying grant, and because ERC relief can’t be received prior to February 29, 2020, ERC credit funds received may not be subject to Washington B&O tax.

B&O Refunds Related to the ERC Credit

In light of limited guidance from the DOR, some taxpayers may have paid B&O tax on the amount of ERC credit funds received from the government. Should you find yourself in this situation, the Washington State Constitution may restrict your ability to claim a full refund of overpaid B&O taxes.

Under the Gift of Public Funds Doctrine, the DOR posited that retroactive tax legislation providing an exemption may retroactively relieve a taxpayer of a tax debt to the state. The state may not grant refunds to taxpayers who overpaid tax prior to the effective date of the retroactive legislation.

If a taxpayer paid B&O tax on ERC funds between March 13, 2020, the effective date of the CARES Act, and February 18, 2021, the day before HB 1095 was signed by Gov. Jay Inslee, the DOR will likely not refund overpayments of B&O tax on ERC funds.

If B&O taxes related to ERC funds were paid on or after February 19, 2021, taxpayers may consider requesting a refund provided a perfected refund claim is filed within the statute of limitations.

If you haven’t paid B&O taxes on ERC credit funds, no further action should be required. You should maintain adequate documentation for exempt amounts in the event of audit by the Washington DOR.

We’re Here to Help

For more information on the ERC credit and B&O taxes and how they may affect you, contact your Moss Adams professional or visit our State & Local Tax Services.